Canada may be the United States’ northern neighbor, but that doesn’t mean import from Canada is easier. Importers from the U.S. still must be prepared to navigate the import clearance process with ease. AFC International, LLC guides clients through the process of successfully importing goods from Canada.

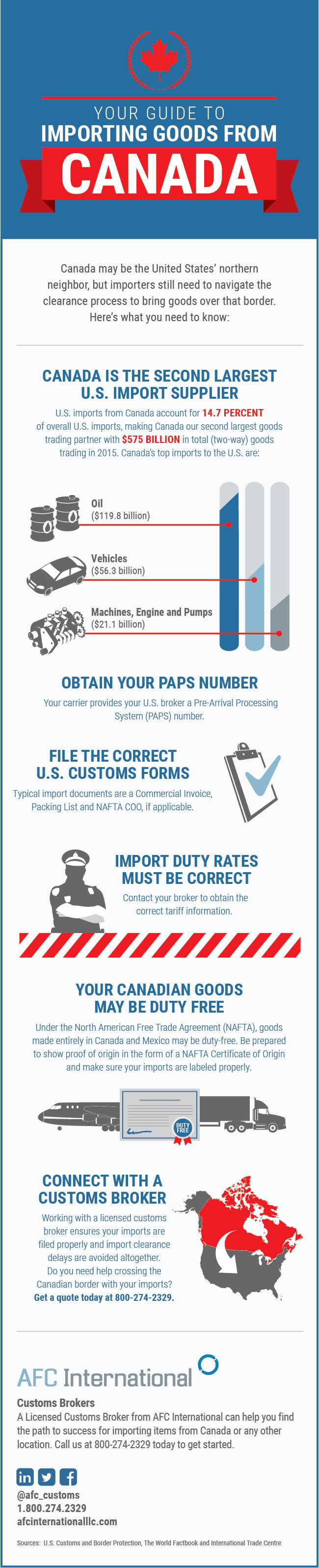

Canada is Second Largest U.S. Import Supplier

Did you know that in 2015 U.S. imports from Canada totaled approximately $325.4 billion annually, which is more than a 50 percent increase over the last 13 years? U.S. imports from Canada account for 14.7 percent of overall U.S. imports, making Canada our second largest goods trading partner with $575 billion in total (two-way) goods trading in 2015. Canada’s top imports to the U.S. are:

- Oil (119.8 billion)

- Vehicles ($56.3 billion)

- Machines, engines and pumps ($21.1 billion)

Obtain Your PAPS Number

If you’re seeking to transport imports from Canada, they are likely heading to the U.S. by a plane or a truck. You need a Pre-Arrival Processing System (PAPS) number, which is used by U.S. Customs and Border Protection (CBP) agents as a shipping control number and by Licensed Customs Brokers to clear shipments crossing the border. The numbers help expedite the release of import shipments.

Truckers picking up shipments from your suppliers at the U.S. and Canadian border should request the PAPS number and send it along with other documentation needed to clear Customs.

File the Correct U.S. Customs Forms

Commodity import requirements and paperwork the CBP requires is best handled by licensed customs brokers. The following is a sampling list of some of the import document paperwork that should always be included with your imports.

- A commercial invoice that lists the purchase price, country of origin and tariff classification of your items.

- A packing list detailing your imports

- A bill of lading that lists goods in the form of a receipt.

- An arrival notice from the U.S. agent.

The U.S. Customs Forms page has all the paperwork you need to file your imports.

Import Duty Rates Must be Correct

Your goods have to be labeled properly to achieve import clearance. Our importer’s guide to duty rates will make sure your imports arrive safely at the border and aren’t met at the border with delays.

Your Canadian Goods May be Duty Free

Under the North American Free Trade Agreement (NAFTA), goods made entirely in Canada and Mexico may be duty-free. To obtain duty-free approvals, be prepared to show proof of origin in the form of a NAFTA certificate of Origin and make sure your imports are labeled properly.

If you’re seeking to import or export your goods under NAFTA, the U.S. has likely negotiated a free trade agreement (FTA) to make it easier and cheaper to do business in North America and around the world. Find out what you need to know about NAFTA and FTA benefits.

Connect With a Customs Broker

Working with a licensed customs broker that utilizes the best resources for importing ensures your imports are filed properly and import clearance delays are avoided altogether.

Leave a Reply

You must be logged in to post a comment.